The Fleecing of America: Raising Alpacas for Tax Breaks

What do alpacas and tax breaks have in common? Yes, you read that right.

It turns out that people are learning that if they use their land to raise alpacas, they will save thousands and possibly hundreds of thousands of dollars in taxes.

Alpacas? What?

Now, it is nothing new that business are encouraged to make “business purchases” for tax purposes, but buying alpacas has become a recent twist to the business tax loophole.

Section 179 of the tax code allows businesses to write off the entire cost of buying new and used equipment, up to $650,000 worth, in the first year of purchase. That immediate depreciation can shave over $200,000 off a tax bill, according to a CNBC report.

Tax exemptions such as these should, in theory, create massive savings used to hire people, reinvest in the business, or in some other way that benefits the larger economy. It’s good for companies buying new machinery or computers.

Why would people raise these animals just to save money on their property taxes?

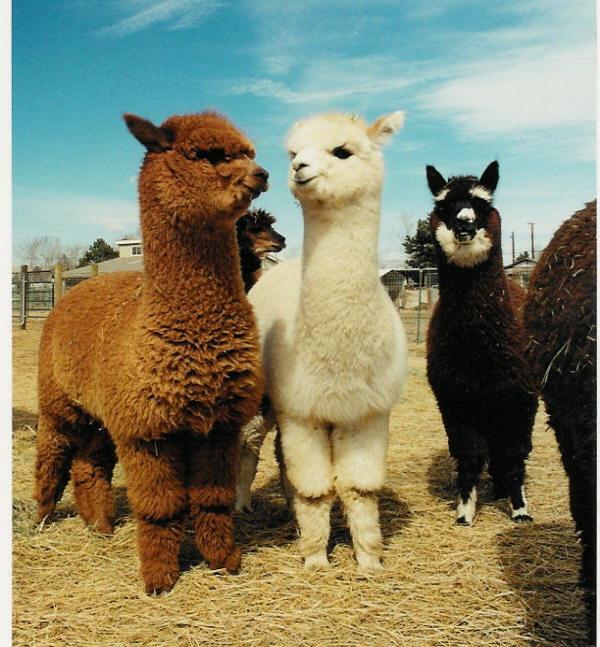

Breeding alpacas is a growing business because there is the possibility of selling their fleece on a commercial level.

The Alpaca Owners & Breeders Association shares with us some of the positives of supporting the industry. “Do you want the next warmest, loveliest, lightweight, water resistant, fire retardant, lovely textile, natural, grown-close-to-home fiber in your closet?” asks Claudia Raessler, who raises alpacas in Maine and is on association’s board of directors. “If the answer to that is ‘yes’, do you want to stimulate U.S. production and the economy?”

Raessler estimates there are about a quarter-million alpacas in the U.S., and while fleece production remains relatively small, she believes that the group is on the cusp of reaching critical mass to become large enough to lure in commercial manufacturers.

The debate is whether or not it makes sense to grant such tax breaks in the long term scheme of things. Is losing all the tax revenue going to result with a better economy from the success of these businesses? If not, then the whole premise is flawed. Since we really do not know what will happen, the business owners have to be optimistic that the commercial viability of the fleece will reach a proportion that will make even the tax code critics shut up.

Whether or not it is real economic stimulation or just business BS, nobody can deny how difficult it is to start a business and so most of these owners likely couldn’t do what they are doing without these financial breaks. The potential for these alpaca farms to make a meaningful impact on the economy is great, and that alone should merit it a sporting chance. Let’s hope it continues to grow—and let’s root for these fluffy animals to reproduce and make us all some money.

It amazes me that the alpaca business is singled out for the tax write off. The fact is every small business qualifies for this break. Economic stimulus was and is the purpose. The same comment that many people may not begin a business is true of any industry.

The alpaca business is a livestock business. Any livestock operation can use the same tax breaks. The alpaca industry is creating jobs and putting money into the economy as well as creating the potential for a return of a commercial clothing manufacturing business in America. Something that died out as jobs moved over-seas. The alpaca is maybe the most earth friendly livestock choice. It does not tear up the land, it encourages the growth of pastures, has gentle manure that does not cause major odor problems for neighbors. In short, the alpaca business is a business. And anyone that does not take full advantage of every economic advantage for their business would soon be using another program called bankruptcy.

There are many businesses cropping up in the US that are utilizing alpaca fleece in production of commercial product. Our company, American Alpaca Textiles is just one. While we are not manufacturing clothing but rather drapery, rugs and upholstery fabrics, all produced in the USA, we are still a viable, progressive company that is indeed supporting jobs and the economy in this country. The alpaca breeders I know work just as hard as other types of livestock farms raising their animals and trying to market their fiber. Alpacas are livestock and breeders deserve whatever tax breaks are available to any livestock industry such as goats, sheep, cattle, swine, etc.

This article should have been led with the last sentence, “Whether or not it is real economic stimulation or just business BS, nobody can deny how difficult it is to start a business and so most of these owners likely couldn’t do what they are doing without these financial breaks. The potential for these alpaca farms to make a meaningful impact on the economy is great, and that alone should merit it a sporting chance. Let’s hope it continues to grow—and let’s root for these fluffy animals to reproduce and make us all some money.”

I agree with Steve Putney. I’m also amazed at how little people understand business tax breaks. Many see it as free money for nothing when it’s not that at all. Today if you purchase an alpaca the person who sold it to you is paying taxes at their regular income rate on that sale. The buyer is then going to pay a vet and retail shops for supplies (feed, pasture seed, halters, buckets, tractor, fencing, barns, etc.). The vet will pay taxes on income and all the supplies will generate sales tax plus all of the manufacturers, distributors and retail shops will pay income taxes on their earnings. If you show your alpaca then you will pay for transportation, show fees, hotel and food. Once again all items where a percentage will filter down into the tax system. If the bought alpaca has baby that is sold or fleece/finished goods that are sold, all of that is taxed at your regular income rate. I haven’t even touched the sales and marketing costs of alpacas and how all of that tax money also gets to uncle Sam. All of this is why Section 179 exists. The small help that a tax break provides upon the initial capital investment is later made up for many times over by the economic growth it provides. It frustrates me that most Americans can’t grasp this. I will guarantee that alpaca owners are paying more in taxes than over 90% of Americans.